louisiana estate tax return

Department of the Treasury. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Louisiana Estate Tax Everything You Need To Know Smartasset

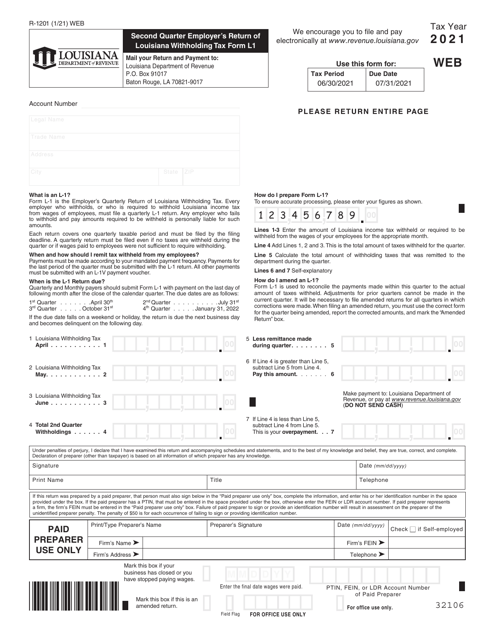

Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes.

. ESBTs on this return. 1 have no impact on 2021 state income tax returns and payments due May 16. Though Louisiana wont be charging you any estate tax the federal government may.

File your taxes stress-free online with TaxAct. 4810 for Form 709 gift tax only. Also there is no special tax calculation for this income and no need to file a separate return.

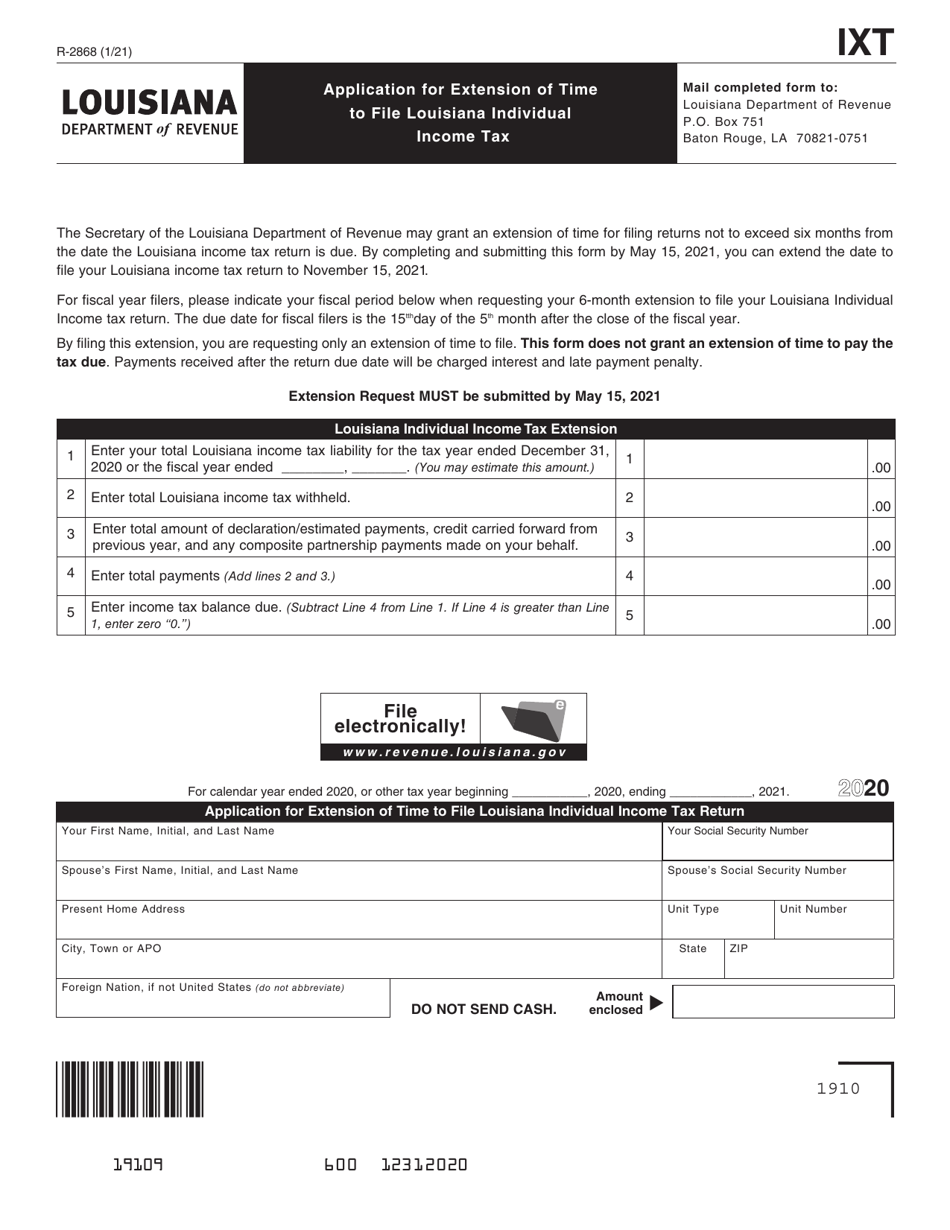

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. Start filing for free online now. This request does not grant an extension of time to pay.

The estate would then be given a federal tax. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must file a fiduciary income tax return. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

BATON ROUGE The filing and payment deadline for 2021 state individual income tax is Monday May 16. Taxpayers can file their returns electronically through Louisiana File Online the states. The estate transfer tax is only.

Ad Access IRS Tax Forms. Return then Form R-6465 should be filed with the Department by the due date of the return for which the extension applies. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal.

Yes Louisiana imposes an estate transfer tax RS. Select the tax type for which you want to request a filing extension. Not The Slightest Need For Tax Hikes In 2021 Gas Tax Financial Asset Estate Tax.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Louisiana estate tax return Sunday February 27 2022 Edit. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine.

Welcome to Online Extension Filing. Grantor trusts as defined in RS. Louisiana Estate Tax Everything.

Tax Rates Applied to Louisiana Taxable Income RS. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. By submitting an extension request you are requesting only an extension of time to file your Louisiana Fiduciary Income Tax return.

Louisiana State Income Taxes for Tax Year 2021 January 1 - Dec. Over 85 million taxes filed with TaxAct. Ad Filing your taxes just became easier.

There is no louisiana inheritance tax for people who died on or before june 30 2004 and an inheritance tax return was not filed before july 1 2008. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Who must file a return There is imposed an income tax for each.

Where do i enter. The federal estate tax exemption was 1170 million in. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn.

Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. 1 Total state death tax credit allowable Per US. However if the estate or trust derived income from louisiana sources the filing of a louisiana fiduciary income tax return is required.

This application will walk you through the process of filing an extension for your taxes. Federal Estate Tax. Complete Edit or Print Tax Forms Instantly.

The Economic Growth and Tax Relief Reconciliation Act of. The federal estate tax exemption was 1170 million in 2021 and.

Thousands Of Louisiana Taxpayers Who Got Extra Refund Should Sit Tight State Says State Politics Theadvocate Com

Pin By Jessica Caperton On Paparazzi Home Business Paparazzi Jewelry Paparazzi Join Paparazzi

Form R 2868 Download Fillable Pdf Or Fill Online Application For Extension Of Time To File Louisiana Individual Income Tax 2020 Louisiana Templateroller

Filing Louisiana State Tax Things To Know Credit Karma Tax

Form L 1 R 1201 Download Fillable Pdf Or Fill Online Second Quarter Employer S Return Of Louisiana Withholding Tax Form 2021 Louisiana Templateroller

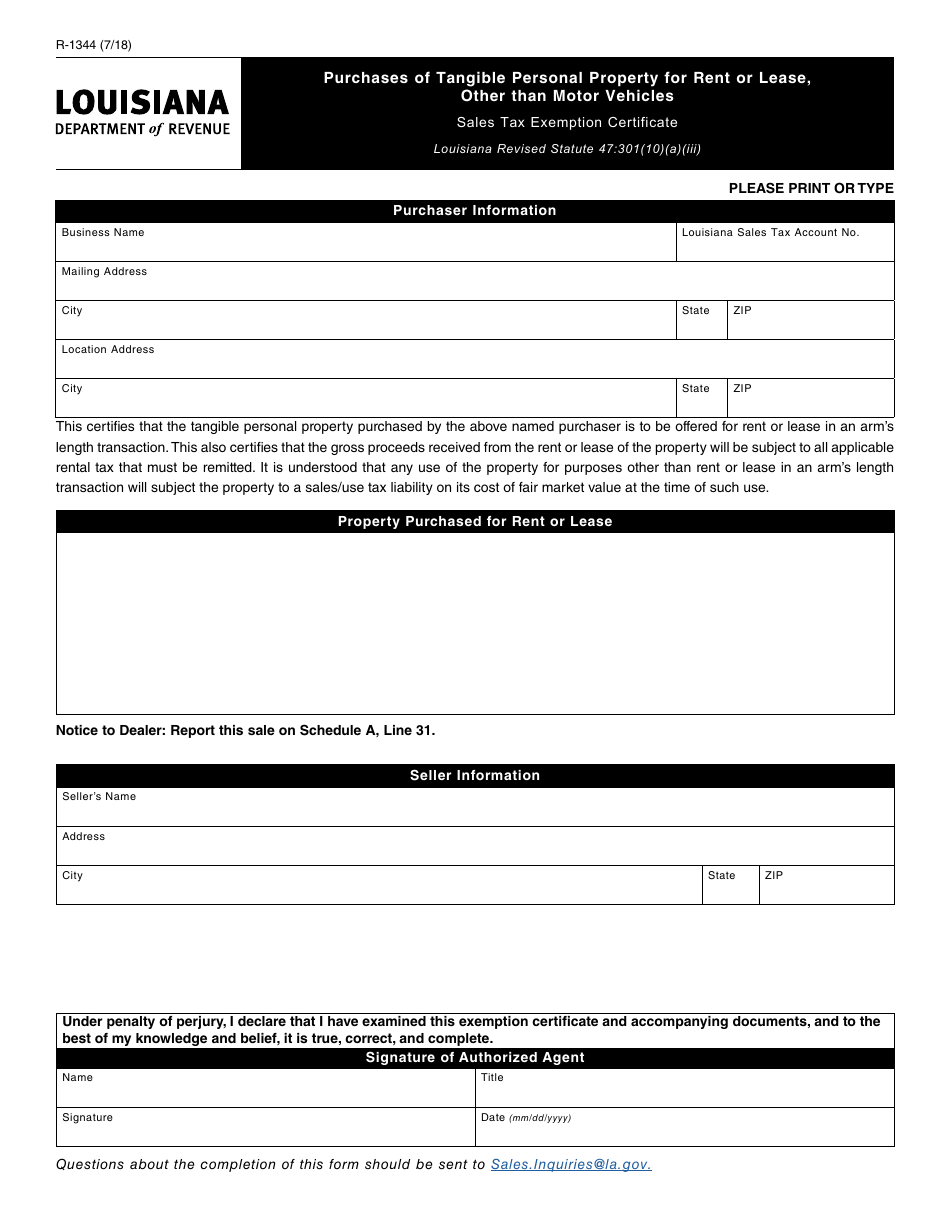

Form R 1344 Download Fillable Pdf Or Fill Online Purchases Of Tangible Personal Property For Rent Or Lease Other Than Motor Vehicles Sales Tax Exemption Certificate Louisiana Templateroller

Louisiana Inheritance Laws What You Should Know Smartasset

Associate Dentist Job Description How To Create An Associate Dentist Job Description Download This Asso Job Description Template Dental Jobs Job Description

First House Then Marriage Iggy Azalea And Nick Young Buy Selena Gomez S Estate Selena Gomez House Starter Home Home Financing

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Income Tax Reporting And Audit Regime Updated

Louisiana Estate Tax Everything You Need To Know Smartasset

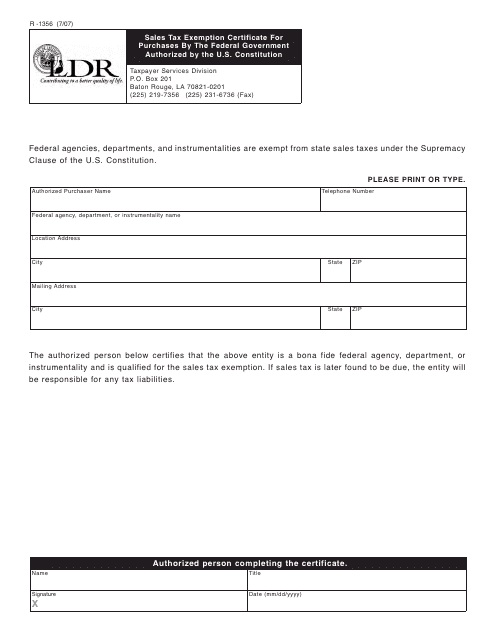

Form R 1356 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases By The Federal Government Authorized By The U S Constitution Louisiana Templateroller

Louisiana Inheritance Tax Estate Tax And Gift Tax